Biden Regime's Debanking Assault on Trump was Part of a Wider Campaign Against the First Amendment Itself

Under the Biden Regime, Debanking became a weapon to not just shut down political opposition, but bypass the First Amendment.

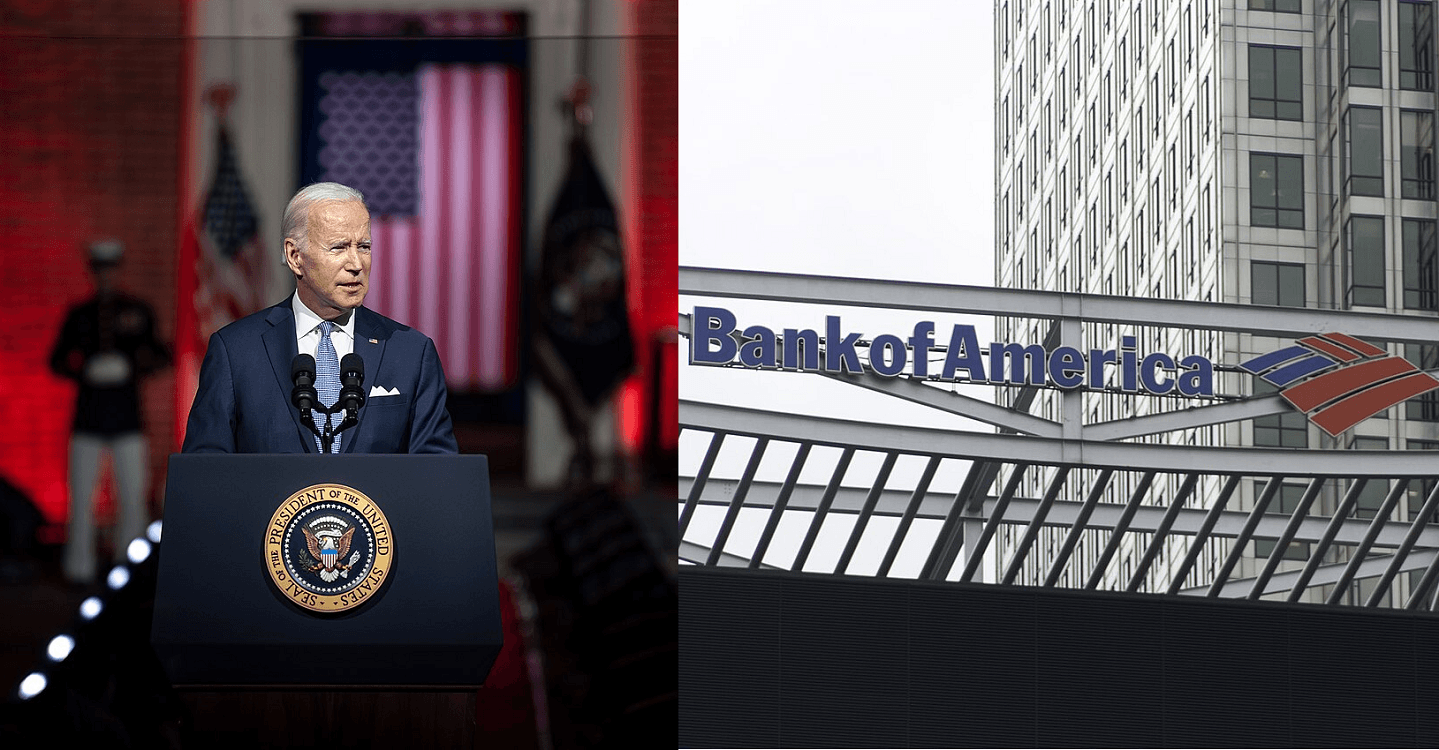

Washington, D.C. – President Trump revealed a shocking personal ordeal this week: major banks like JPMorgan Chase and Bank of America shut him out, refusing to handle his accounts worth tens of millions after his first term ended in 2021. This wasn't random—it stemmed directly from pressure by Biden administration regulators, who wielded vague "reputational risk" rules to target him over his January 6 speech at the Ellipse. Sources inside the banks confirmed Biden's banking overseers at the Office of the Comptroller of the Currency, FDIC, and Federal Reserve threatened increased scrutiny and fines if they continued serving Trump, labeling him a risk despite decades of business. Trump recounted on CNBC how Bank of America CEO Brian Moynihan, once eager for his business, flatly refused to open accounts for over a billion dollars, forcing him to scatter funds across smaller institutions. This weaponization of finance against a former president highlights a broader campaign by the previous regime to silence opposition through economic strangulation.

But Trump's experience is just the tip of the iceberg. Ordinary citizens have faced similar debanking for holding religious or political views that clashed with leftist agendas. For instance, the National Committee for Religious Freedom, a Christian organization advocating for faith-based causes, had its accounts abruptly canceled by JPMorgan Chase without clear explanation, citing internal policies that seemed to target their biblical stance. Churches and ministries across the country reported sudden closures of accounts, leaving them scrambling to manage donations and operations—acts that smacked of discrimination against Christian values. Donald Trump Jr.'s events were hit when payment processors and banks pulled support, effectively crippling fundraising efforts tied to pro-America messages. In another case, Indigenous Advance Ministries, a group aiding orphans and widows in Uganda, was debanked by Bank of America for what appeared to be their evangelical outreach. Even gun owners and Second Amendment supporters have been flagged, with banks like Chase terminating relationships under pressure to avoid "controversial" clients. These aren't isolated incidents; states like Florida and Tennessee passed laws in 2024 to combat such practices, recognizing the pattern of banks punishing views on life, family, and freedom. On X, users shared stories of conservatives losing access for supporting traditional marriage or opposing mandates during COVID, underscoring how this tactic extends to first responders and everyday patriots.

Debanking poses a grave danger to free speech, acting as a modern tool to muzzle dissent without due process. When banks, under government coercion, cut off financial lifelines, it creates a chilling effect—people self-censor to avoid economic ruin. This isn't about risk management; it's about control, echoing tactics like Operation Choke Point, where regulators pressured banks to starve industries they disliked. For religious groups, it threatens liberty by excluding them from the economy based on faith, potentially forcing ministries to close or operate underground. Politically, it silences voices on issues like election integrity or border security, as seen in the post-January 6 sweeps where banks scanned customer data for anyone near D.C., handing it to the FBI without warrants. This erodes trust in institutions, turning finance into a weapon against the First Amendment, where expressing unpopular opinions can lead to financial exile. As one analysis noted, without safeguards, debanking becomes a form of civil death, barring participation in society and amplifying government overreach.

Now, the Trump administration is striking back decisively. President Trump is set to sign an executive order as early as this week, directing regulators to investigate and fine banks for politicized debanking. The order will enforce laws like the Equal Credit Opportunity Act and antitrust statutes against institutions discriminating based on political or religious beliefs, including those targeting Christians and cryptocurrency firms. Penalties could include hefty fines, consent decrees, and Justice Department referrals, with banks required to eliminate biased internal policies. This builds on earlier calls, like House Oversight probes into whether government meddling drove these actions, similar to censorship on social media. Comptroller Jonathan V. Gould affirmed plans to depoliticize banking and ensure fair access. On X, the move is hailed as essential to ending abuses, with posts emphasizing how it protects conservatives from the censorship cartel. This executive action promises to restore financial freedom, ensuring banks serve all Americans without fear or favor.

Like this article